Arrow Capital Partners

私人房地产公司

关于我们

我们专注于多种行业和资产类别中的增值和重新配置机会,同时投资于股权和债务。

Arrow Capital Partners 是一家私人投资公司,专门从事于商业地产增值和重新配置机会,同时投资股权和债务。

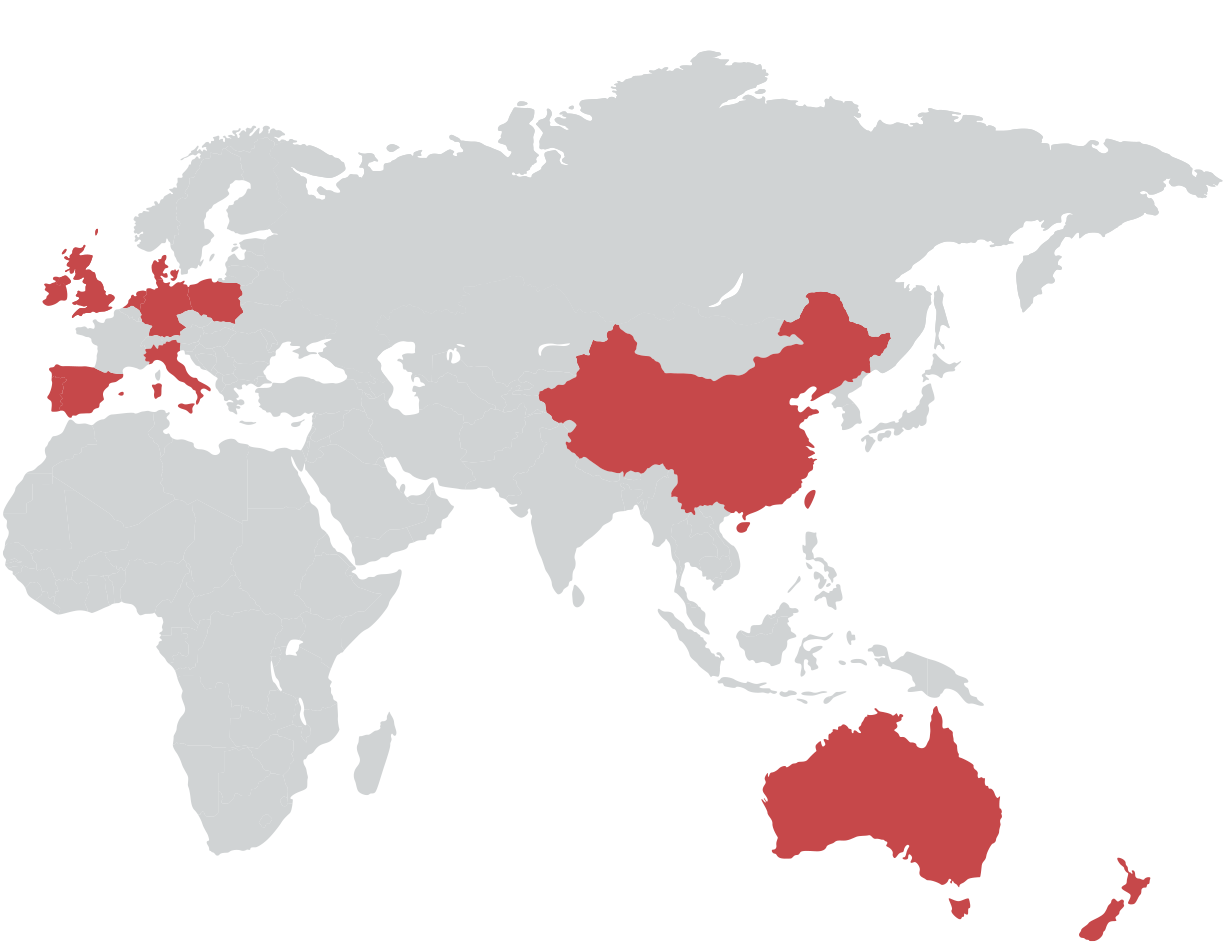

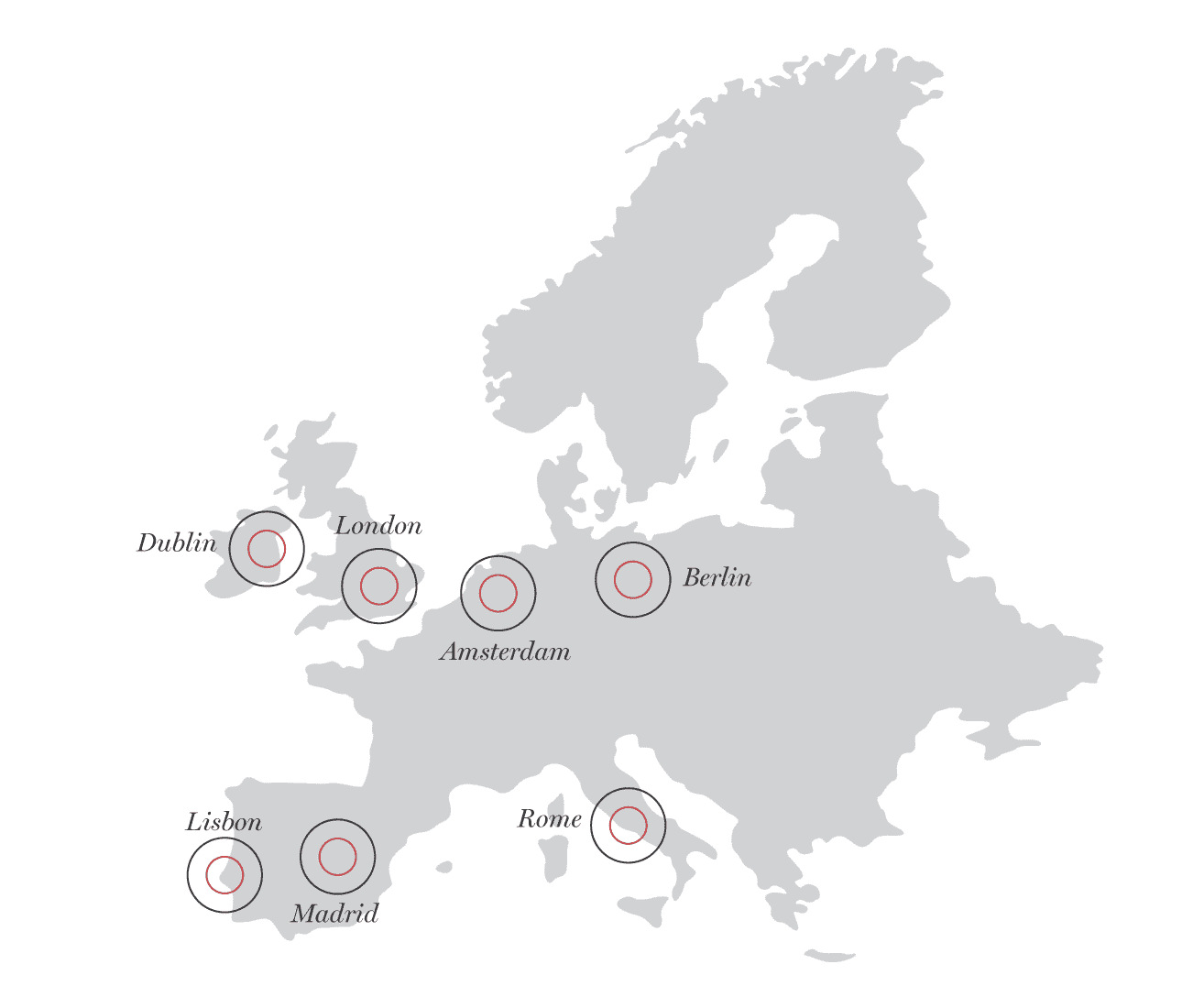

Arrow 在亚太地区和欧洲设有12个办事处,并管理超过50亿美元房地产资产。我们作为投资者和经营者,在市场上寻找有吸引力的投资机会,并与我们的优先投资人一起利用我们的自有资金,提供混合型资金解决方案。

Arrow Capital的每位合伙人都有20多年的全球房地产经验,拥有并管理着亚太和欧洲一些最大的独立投资和资产管理平台,并在全球机构和私募股权投资者中享有盛誉。

我们的不同之处

我们是一家在投资方式上具有企业家精神且自律的合伙企业。

作为一个具有商业洞察力、了解宏观趋势、在所投资的每一个市场都具有实地经验和专业知识的私营合伙企业,我们有能力采取果断的行动,并在机会出现时迅速作出反应。

由于我们对所管理的项目进行了大量的个人投资,因此我们的目标与投资合伙人的目标高度一致。这使我们在退出投资的过程中,一直坚定不移地注重透明度和成绩。

我们的能力

我们因积极回应且亲力亲为地为房地产投资人服务而享有盛誉。

我们的“端到端”房地产投资和管理能力意味着我们积极参与整个过程中的每个阶段,从选择收购的资产以及战略和资产计划的创建、实施和交付,到租赁和资本支出的批准。

在过去9年中,我们的合伙人在亚太地区监管了150亿美元的投资,并在欧洲监管了100亿美元的投资和收购。

Arrow在亚太地区和欧洲有一支由50名投资、资产管理和融资专业人士组成的团队,且这一数字仍在增长。

我们与许多专业的投资合伙人建立了业务关系,包括:

- 全球机构

- 私募股权

- 基金经理

- 家族理财室

- 个人投资者

投资类型:

- 物流投资

- 核心增益型和增值投资

- 基金启动和独立账户授权

- 住宅楼盘开发

- 国际房地产投资管理平台的管理

- 企业活动

- 债权

- 房地产开发

- 办公室

Filter location:

我们的全球业务

我们是一家国际房地产公司,可满足全球资本合伙人的需求。

虽然我们的关系网有助于提高我们投资机会的广度和质量,但我们对市场的高选择性仍保持严谨态度。我们的决策会考虑到广泛的因素,包括市场周期,以及我们适时调整资本结构的能力以优化风险调整回报。

我们与租户的关系是我们成功的关键。定期面对面会议可确保我们满足其需求和愿望,同时让我们能经常检查我们的资产。

认识我们团队

我们的团队在亚太地区和欧洲市场的房地产、私募股权、银行和法律及合规方面,拥有丰富的经验。

Arrow 合伙企业

Martyn McCarthy

Managing Partner

Kurt Wilkinson

Partner

Christian Bearman

Partner

Katherine Parker

Partner, Head of Investment Management Europe

Damian Horton

Partner, Asia-Pacific

Stuart Ross

Partner, Asia-Pacific

Robert Howe

Head of Real Estate, Europe

Ronan O’Donoghue

CFO

Danilo Hunker

Head of Germany

Martien van Deursen

Head of Benelux

Sam De Girolamo

Head of Italy

新闻报道

Arrow Capital Partners 的全球新闻。

Arrow and Cerberus nail down first deal of 2023 for €3bn platform

Arrow Capital Partners and Cerberus have completed their first deal this year for their €2bn Strategic Industrial Real Estate (SIRE) platform.

Arrow-Cerberus lease 81,076 sq ft at Aviator 80 in Ellesmere Port, Cheshire

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has leased Aviator 80, an 81,076 sq ft logistics property at Ellesmere Port in Cheshire. The asset is part of Arrow’s €3bn Strategic Industrial Real Estate (SIRE) joint venture with Cerberus.

Arrow boosts Dutch team with the appointment of Martijn Adelaar

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has appointed Martijn Adelaar as Senior Asset Manager in the Benelux team.

Arrow-Cerberus acquires logistics refurbishment project in Alcala de Henares, Madrid

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has acquired a 16,000 sqm logistics warehouse in Alcala de Henares for its €3billion Strategic Industrial Real Estate (SIRE) joint venture with Cerberus.

Arrow adds two more logistics assets to its Dutch SIRE portfolio

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has acquired two logistic assets in the Netherlands on behalf of its €3bn Strategic Industrial Real Estate (SIRE) joint venture with Cerberus. The assets were purchased in separate transactions for a total of c.€20 million.

Arrow bolsters team in Germany with two new hires

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has boosted its team in Germany with two new appointments in the Düsseldorf office.

Arrow confirms largest ever UK warehouse sale

Arrow Capital Partners has confirmed it has bought the Amazon-let warehouse facility at Wakefield Hub from Mountpark Logistics for £233m. React News revealed the impending sale of the warehouse in October in what is the largest price ever achieved for a single warehouse in the UK. Among the interested parties were LCN Capital Partners, Aviva Investors and Abrdn, as well as Korean and Malaysian investors.

Australian firm Arrow aims for last-mile delivery logistics

The real estate investor’s SIRE venture is set to invest €200 million in industrial and logistics properties in Ireland in the next year. Australian-headquartered real estate investor Arrow Capital Partners is confident of reaching its €200 million initial target of industrial and logistics properties in Ireland within the next 12 months. Cormac Dunne, head of Ireland at Arrow, told the Business Post that it is looking to acquire properties in the Greater Dublin Area and Cork as well as in Galway and Limerick.

Arrow buys two logistics assets for Dutch SIRE portfolio for €20m

Arrow Capital Partners has purchased two logistics assets in the Netherlands on behalf of its Strategic Industrial Real Estate (SIRE) joint venture with Cerberus for €20m. The assets, purchased in separate transactions, are Arrow’s first development projects in the Netherlands. The first is a last-mile, 14,445 sq m (155,000 sq ft) logistics development at Hoensbroek, which will be developed by Merle Vastgoed. It is prelet on a long-term lease to Fource, a distributor of car parts, lubricants and tools. The completed warehouse will include 12 loading docks, two level doors and will be constructed to a BREEAM Excellent rating.

Dell will move its Australian and New Zealand head office to The Zenith Towers in Chatswood, New South Wales.

Dell will close its three current New South Wales sites in Frenchs Forest, St Leonards and Macquarie Park, the tech giant said today in a statement. Zenith Towers is comprised of two towers with a central atrium and is owned by real estate company Arrow Capital Partners and global private investment firm Starwood Capital.

Starwood Capital, Arrow Capital JV recapitalizes properties in Australia

A joint venture between an affiliate of Starwood Capital Group and Arrow Capital Partners, an investor and operator of real estate, has entered into an agreement for the recapitalization of a portfolio of office and industrial assets alongside Altis Property Partners. The recapitalization will allow further investment in the portfolio and provide liquidity for some investors.

Arrow to develop 16,000m2 spec logistics facility in Madrid

Arrow Capital Partners has acquired a 30,000 m2 brownfield site in the Corredor de Henares in Madrid to speculatively develop into a 16,000 m2 logistics facility. Project Alcala is Arrow’s first build-to-own logistics development in Spain for its €3 bn Strategic Industrial Real Estate (SIRE) joint venture with Cerberus. Located within Madrid’s outer ring road, the new warehouse will meet strict sustainability criteria, including BREEAM ‘very good’ rating.

Arrow Capital buys €80m warehouse portfolio in maiden Nordic deal

Arrow Capital Partners has entered the Nordics with the acquisition of an €80m warehouse portfolio in Denmark. The European and Asia-Pacific real estate investor has bought the Lacus Portfolio of 10 warehouses on behalf of Strategic Industrial Real Estate (SIRE), the firm’s European industrial property investment fund backed by Cerberus Capital Management. Arrow Capital said the majority of assets are located in Copenhagen and the “Triangle Area” covering Vejle, Kolding and Fredericia. The 111,537sqm portfolio was acquired with 97% occupancy.

Arrow grows its German urban logistics portfolio

Arrow Capital Partners has acquired an 8,310m² urban logistics asset in Seevetal, south of Hamburg. Located on the strategically important Maschener Kreuz motorway junction between the A7, A39 and A1 highways, the asset is currently fully leased to a German furniture wholesaler. The property is split between two buildings that include 26 loading docks and four ground floor entry points.

隐私政策

Arrow Property Investments Pty Ltd Privacy Policy

1) Objective

The purpose of this Privacy Policy is to demonstrate how Arrow Property Investments Pty Ltd (Arrow) implements practices, procedures and systems that ensure it complies with the Australian Privacy Principles (APPs) and provisions in the Privacy Act 1998 (Cth) (the Act) in relation to our collection, use, holding and disclosure of personal information and sensitive information.

2) Personal Information

Personal Information refers to information or an opinion about an identified individual, or an individual who is reasonably identifiable, regardless of whether it is true or recorded in a material form.

3) Sensitive Information

Sensitive information is personal information regarding an individual’s race, political opinion and affiliations, religious beliefs or affiliations, philosophical beliefs, membership of professional or trade unions or associations, sexual orientation or criminal record.

4) Collection of personal and sensitive information

Arrow will not collect personal information unless the information is reasonably necessary for one or more of its functions and activities. Further, sensitive information may only be collected if it is necessary and the individual consents to the collection.

All collection of personal information must be by fair and lawful means. Whenever it is reasonable and practicable to do so, Arrow will only collect personal information about an individual from that individual, and otherwise will take reasonable steps to ensure that the individual is made aware of the required matters.

Arrow may collect information about individuals’ visits to Arrow-owned websites using automatic collection tools, such as “cookies”. We do this in order to monitor traffic patterns and serve individuals more efficiently if they revisit the sites. Such tools do not identify individuals personally, but they can provide information such as the individuals’ browser type and language, access times, Internet Protocol addresses and behaviour (e.g. pages visited, links clicked).

5) Use and Disclosure of personal information

By use of this website you acknowledge that you are put on notice that Arrow may collect personal information. Arrow will use and/or disclose personal information for the primary purpose for which it was collected or received. Such primary purposes may include:

a) to deliver goods and services to Arrow’s clients or business partners, associates and other persons with whom we engage in business with;

b) to administer and improve the performance of Arrow-owned websites;

c) to address and respond to concerns or other correspondence from those who deal with us;

d) to provide information updates via email or social media platforms eg Instagram or Facebook.

Personal information may only be used or disclosed for the primary purpose for which it was collected. Using it for a secondary purpose is prohibited unless:

a) the individual has consented to that secondary purpose;

b) the individual would reasonably expect the disclosure or use for the secondary purpose which is related to the primary use; or

c) the secondary purpose is required or permitted by law

Arrow will never sell or rent personal information collected by it to third parties for marketing purposes.

Once the information is no longer of use to Arrow, and if there is no legal requirement to retain it, all reasonable steps will be taken to either destroy or de-identify the information.

6) Quality of Information

Arrow will take all reasonable steps to ensure that the personal information that it collects, uses and discloses is accurate, up to date and complete. We will also take steps to maintain and update that information when advised of incorrectness or change.

If an individual establishes that personal information which ARROW holds about him/her is not accurate, complete and up- to-date, Arrow will take all reasonable steps to correct the information.

7) Security of information

We have an obligation to take such steps as are reasonable in the circumstances to protect any personal information we hold from misuse, interference, loss, unauthorised access, modification or disclosure.

8) Access to information Individuals have a right to request access to their personal information and to request its correction by contacting Arrow via the contact details provided on our website. On request by a person, Arrow will take all reasonable steps to let the person know, generally, what sort of personal information it holds, for what purposes, and how it collects, holds, uses and discloses that information.

9) Cross border disclosure of information

Our use of data cloud storage means that data may be stored overseas. Customer information may only be accessed by employees of Arrow and will not be used for marketing purposes without specific prior permission.

Should personal or sensitive information be transferred or disclosed to overseas entities, it is the obligation of the discloser to take all reasonable steps to ensure that the receiving entity abides by the Australian Privacy Principles and the Privacy Act.

10) General

Arrow reserves the right to change this Policy from time to time, in accordance with relevant circumstances. If we do so, we will post the revised Policy here. We may also give notice by other means, such as a message on our website.

To obtain a copy of this policy please contact Arrow’s Privacy Officer by emailing

Any complaints, problems or queries regarding Arrow’s management of personal information should be directed to ARROW’s Privacy Officer by emailing

条款

Thank you for visiting our website. This website is owned by Arrow Capital (ACN 610662274). By accessing and/or using this website and related services, you agree to these Terms and Conditions (Terms). You should review these Terms carefully and immediately cease using our website if you do not agree to these Terms. In these Terms, ‘us’, ‘we’ and ‘our’ means Arrow Capital and our related bodies corporate.

Accuracy, completeness and timeliness of informationThe information on our website is not comprehensive and is intended to provide a summary of the subject matter covered. While we use all reasonable attempts to ensure the accuracy and completeness of the information on our website, to the extent permitted by law, including the Australian Consumer Law, we make no warranty regarding the information on this website. You should monitor any changes to the information contained on this website.

We are not liable to you or anyone else if interference with or damage to your computer systems occurs in connection with the use of this website or a linked website. You must take your own precautions to ensure that whatever you select for your use from our website is free of viruses or anything else (such as worms or Trojan horses) that may interfere with or damage the operations of your computer systems.

We may, from time to time and without notice, change or add to the website (including the Terms) or the information, products or services described in it. However, we do not undertake to keep the website updated. We are not liable to you or anyone else if errors occur in the information on the website or if that information is not up-to-date.